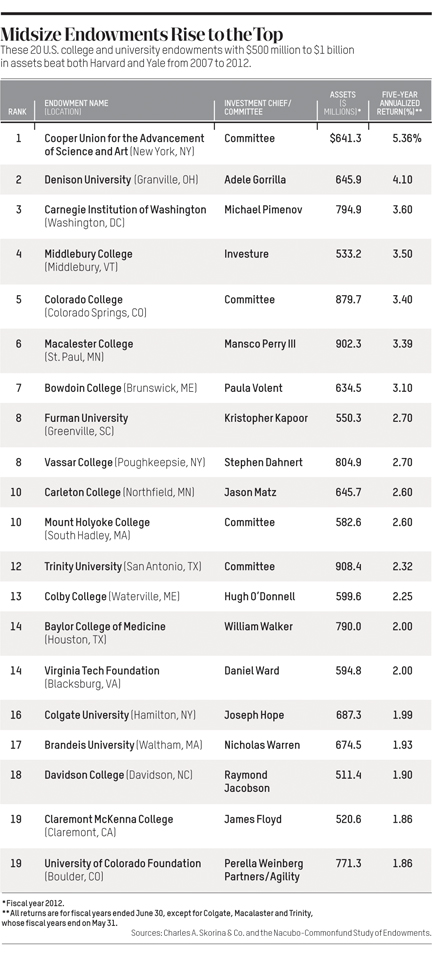

A lengthy in the November issue of Institutional Investor magazine highlights Â鶹ľ«Ć· as being among a select group of 20 midsize educational endowments that “schooled” their larger peers from June 2007 through June 2012.

The article states that annualized returns for this group of high performers ranged from 1.86 percent to 5.36 percent, besting both Harvard (up 1.24 percent a year) and Yale (up 1.83 percent).

Â鶹ľ«Ć· and the other midsize stars, the article states, are those with $500 million to $1 billion in assets. They outperformed the 1.7 percent median return for endowments with more than $1 billion in assets, according to the Washington-based National Association of College and University Business Officers (Nacubo).

Â鶹ľ«Ć·â€™s annualized return over the five-year period was 1.99 percent, and its endowment for fiscal year 2012 was $687.3 million.

“This positive report showcases the results of our financial team making good decisions during some difficult times and building on sound practices we have developed over many years at Â鶹ľ«Ć·,” said Â鶹ľ«Ć· President Jeffrey Herbst. “It is an encouraging sign for our future.”